In today’s financial world, your credit score is more than just a number; it plays a significant role in influencing applications for jobs and rental properties, as well as in securing better interest rates and obtaining loans, credit cards, and mortgages. If you’ve found your way to gomyfinance.com, you’re probably trying to understand how your credit score works, why it matters, and—most importantly—how to raise it. With a focus on gomyfinance.com, we’ll go over the basics of credit scores in this lengthy 1,200-word article so you can take charge of your financial future.

What is a Credit Score?

Your creditworthiness or likelihood of repaying a loan is indicated by your credit score, which is a three-digit figure that normally ranges from 300 to 850. Lenders view you as more “trustworthy” if your score is higher, which makes it simpler to be approved for different types of credit and frequently at better rates.

Common Credit Score Ranges

| Score Range | Description |

|---|---|

| 300–579 | Poor |

| 580–669 | Fair |

| 670–739 | Good |

| 740–799 | Very Good |

| 800–850 | Excellent |

gomyfinance.com Credit Score uses these industry-standard ranges to help users understand where they stand and what steps they need to take to improve their credit health.

Why Your Credit Score Matters

- Loan approval: Prior to granting credit cards or loans, the majority of lenders look up your credit score.

- Interest rates: You can save money by taking advantage of lower interest rates, which are frequently associated with higher credit scores.

- Jobs and rentals: When making decisions, some employers and landlords take your score into account.

- Flexibility in terms of finances: A high score increases your access to goods and services and, in an emergency, can make the difference between acceptance and rejection.

Read more: DoctorHub360.com Neurological Diseases

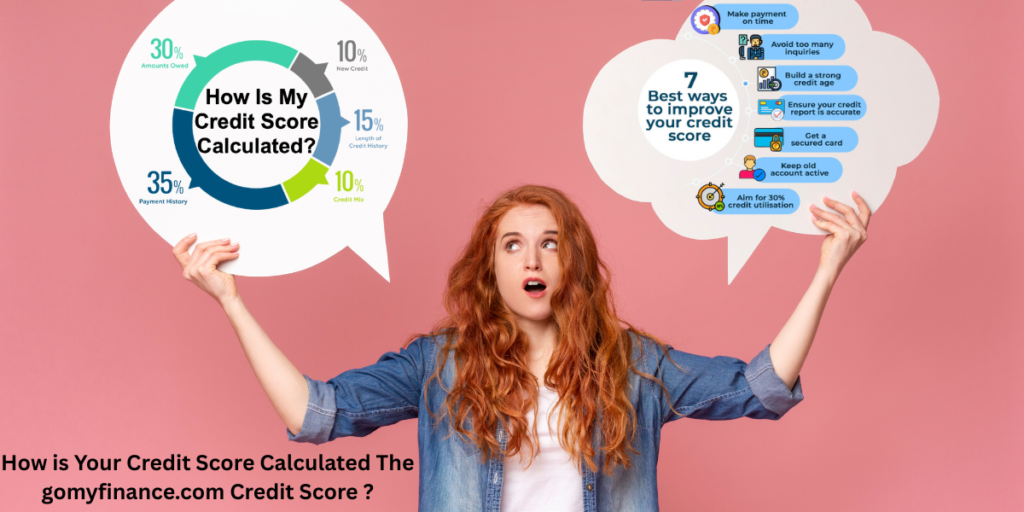

How is Your Credit Score Calculated? (The gomyfinance.com Credit Score)

Usually, a number of factors are used to determine credit scores, but your payment history is the most crucial. The components typically disassemble as follows:

- History of Payments (35%),

- Paying on time raises your score.

- Missed or late payments have a detrimental effect.

- Credit Utilization/Amounts Due (30%):

- This represents the proportion of your available credit that you are utilizing.

- Your score may suffer if you use more than 30% of your limit.

- Credit History Length (15%):

- The longer you’ve been in charge of your credit, the better.

- Established, accountable behavior is preferred by lenders.

- Credit Types Used (10%):

- Keeping track of various kinds—loans, credit cards, etc.—can be beneficial.

- 10% New Credit:

- Opening a lot of new accounts quickly could be a sign of danger.

In addition to tracking these variables, gomyfinance.com provides personalized improvement insights.

Read more: ZO35-G25DA74 Model TV

How gomyfinance.com Credit Score Helps You Track and Improve

Gomyfinance.com offers a user-friendly dashboard that allows users to:

- Get a free check of your credit score right now.

- View a summary of the effects that each factor has on your score.

- Keep an eye on your credit utilization—the proportion of available credit to used credit.

- Get reminders for due dates and examine your payment history.

- Keep tabs on how new credit applications affect your score.

- Get tailored advice on how to improve your credit score.

Practical Ways to Best Your Credit Score with gomyfinance.com Credit Score

- Always pay your bills on time.

- Avoid “late payment” marks, use auto-pay, and set up reminders.

- Reduce the Use of Your Credit

- Aim to maintain balances under 30% of your entire credit limit.

- Priorities’ paying off high-interest credit cards.

- Maintain Old Accounts Open

- The longer your credit history, the better for your score.

- Closing unused cards can lower your average account age and impact available credit.

- Restrict the number of new credit applications

- Your score may temporarily decline with each new “hard inquiry.”

- Only apply for the credit you require.

- Examine your credit reports frequently.

- Your reports are accessible on gomyfinance.com, which aids in identifying mistakes early.

- Dispute any errors that might be lowering your score.

- Spread Out Your Credit Types

- It is beneficial to have a combination, such as a credit card and an installment loan.

The Benefits of a High Credit Score

- Simple loan approvals: You are seen as less dangerous by lenders.

- Reduced expenses: Get the best terms and rates.

- Increased bargaining power: Be more confident when you shop around.

- Reduced stress: Quicker processing and increased likelihood of approval for leases on cars, apartments, and even jobs in some industries.

Read more: 5StarsStocks.com Best Stocks List

Monitoring Your Credit Score on gomyfinance.com Credit Score

The purpose of gomyfinance.com is to explain the credit score calculation process by offering:

- notifications of significant changes in real time.

- suggestions for both long-term tactics and short-term successes.

- simulations of the possible effects of certain actions (such as paying off a credit card) on your score.

Both novice and experienced credit users can more easily optimise their financial status with their straightforward, actionable feedback.

Common Credit Score Myths Busted

- Your credit score drops when you check it: Untrue. This is only done through “hard pulls” from lenders; using gomyfinance.com to check is a “soft pull” that has no impact.

- It’s sometimes untrue that closing cards always raise your score. Your credit utilisation ratio and average account age may suffer if you close old accounts.

- To raise your score, you must maintain balance: Untrue. Building credit doesn’t require paying interest; instead, try to pay off balances in full.

- Your score is impacted by your income: Untrue. Only your debt commitments and repayment trends are relevant; your salary is not.

Frequently Asked Questions (FAQs)

How frequently does gomyfinance.com Credit Score update my score?

- usually once a month. Most customers prefer a monthly cheque, though some lenders report more frequently.

Will my score change if I use gomyfinance.com Credit Score?

- No. Self-assessment is regarded as a “soft” inquiry.

What happens if I discover a mistake in my credit report?

- Quickly submit a dispute for a correction through the gomyfinance.com platform or directly to the main bureaus.

Can someone with a “fair” score get a loan?

- It’s feasible, but you might have to deal with less flexible terms and higher interest rates. Better options may become available if you raise your score.

Read more: Coyyn.com Business Model Explained

Conclusion:

One important and potent financial tool that you can actively control and raise is your credit score. It’s now simpler than ever to monitor your score, comprehend its factors, and take concrete action to raise it thanks to websites like gomyfinance.com. You are well on your way to a healthier financial future—and all the opportunities that come with it—if you priorities making your payments on time, manage your debts sensibly, maintain a variety of credit accounts, and keep an eye out for errors on your credit card report. Your future self will appreciate it if you start now!

FAQs

1.Describe a credit score and its importance.

Your creditworthiness is generally expressed on a scale, called the “credit score.” The credit rating often determines whether you may receive a credit card or a loan. Higher scores allow you to avail favourable interests, and at times, the scores even prevent the driving of jobs or rentals.

2.How is my credit score being monitored on the Site, gomyfinance.com Credit Score?

This platform allows real-time credit score monitoring and updates, along with remedies to give the user an opportunity to raise such score over time.

3.Does checking my credit score on gomyfinance.com Credit Score hurt it?

No, checking your own credit score will not lower it; this is called a “soft inquiry.”

4.How often will my credit score be updated on gomyfinance.com Credit Score?

While certain lenders may report more often, credit scores are generally updated on a monthly basis.

5.What factors influence my score the most?

The key factors are the payment history, amount owed/credit utilization, and the length of the credit history; followed by the types of credit, plus recent inquiries.

6.Do they use gomyfinance.com Credit Score for disputing credit report errors?

Yes, the platform provides tools and guidance to help you file disputes and correct any functions found on your report.

7.Is my information secure with gomyfinance.com Credit Score?

Such a website implements industry-standard security measures in order to protect the subscriber’s personal information and financial information.

8.Can gomyfinance.com Credit Score help me increase my credit scores?

Although gomyfinance.com itself cannot increase your score, it does provide some actionable tips, tracking, and insights to help one improve the credit over time.

9.What shall I do if my scores fall immediately?

Inquire into possible recent activity causing this, such as late payments, high credit utilization, or fresh hard inquiries, and use the resources at gomyfinance.com Credit Score to pinpoint and counteract the reason.

10.Does gomyfinance.com Credit Score charge for its credit score services?

Basic score checks are free. Some fancy features or credit monitoring services may attract a premium charge-see the site for details.